colorado estate tax rate

Colorado Concern agreed to stop pursuing its initiatives in exchange for a bill cutting property taxes by 700 million in the 2023 and 2024 tax years with the state kicking in roughly 400 million to to make up for the revenue. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein.

Real Wealth Network California S 1 Real Estate Club Creating Passive Income Real Estate Investing Estate Tax

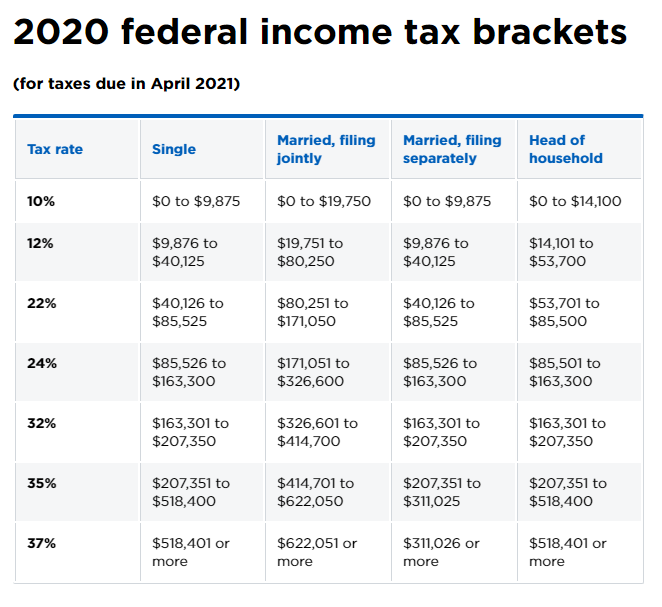

The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income.

. The Colorado State Tax Fee Due Date Guide shows filing and payment deadlines for both business and individual taxes. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is based on this credit. A tax of 10 mills on a property with an assessed value of 10000 is equal to 100 10000 x 01.

The maximum federal EITC amount you can claim on your 2021 tax return is 6728. Counties in Colorado collect an average of 06 of a propertys assesed fair market value as property tax per year. So if youre.

Colorado also has a 290 percent state sales tax rate a max local sales tax rate of 830 percent and an average combined state and local sales tax rate of 777 percent. 6 hours agoColorado state representatives approved legislation to temporarily cut property taxes voting unanimously Friday to send the bill to the governors desk. In other words you never have to pay an estate tax while you.

For 2021 this amount is 117 million or 234 million for married couples. Estate income tax is a tax on income like interest and dividends. Colorado estate tax applies whether the property is transferred through a will or according to Colorado intestacy laws.

Colorado imposes a sales tax rate of 290 percent while localities charge 475 percent for a combined 765 percent rate. The Colorado EITC is equal to 10 of the federal EITC youre eligible for based on your income. The 2022 state personal income tax brackets are updated from the Colorado and Tax Foundation data.

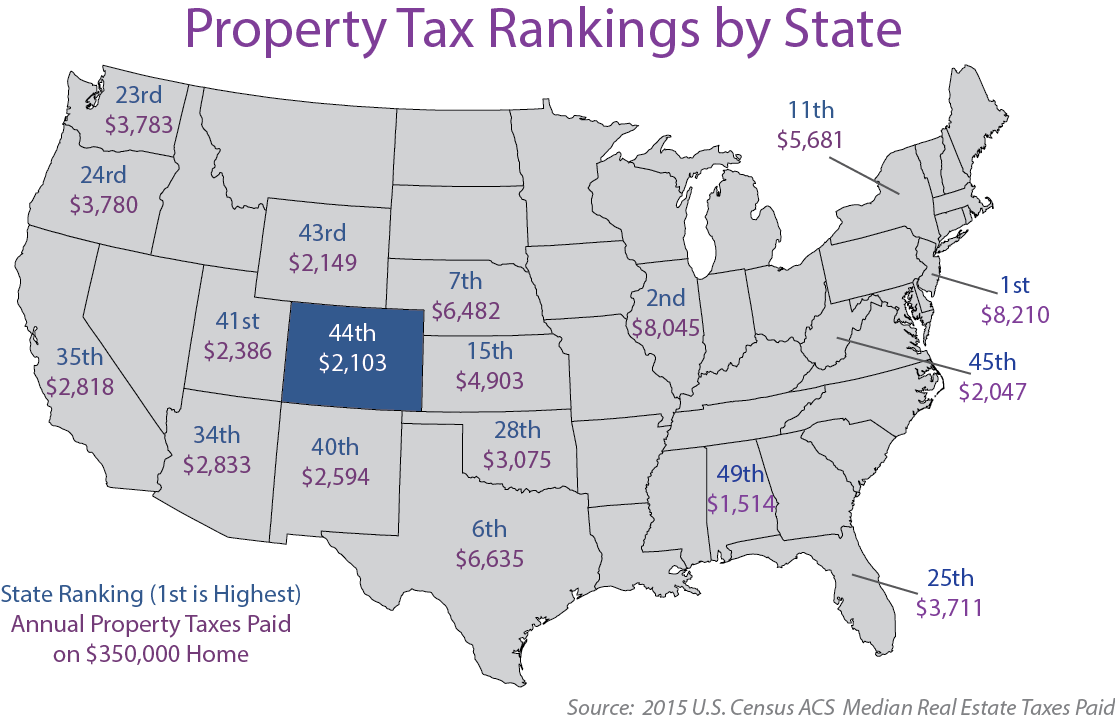

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. Here is a list of states in order of lowest ranking property tax to highest. The Colorado Department of Revenue Division of Taxation will hold a public rulemaking hearing on the following sales tax rule at 1000 AM.

A state inheritance tax was enacted in Colorado in 1927. So if you pay 1500 in taxes annually and your homes market value is 100000 your effective tax rate is 15. Unlike some states Colorado does not currently.

Before the official 2022 Colorado income tax rates are released provisional 2022 tax rates are based on Colorados 2021 income tax brackets. 1 day agoPatrisse CullorsYouTube. Estate Taxes in Colorado.

Federal legislative changes reduced the state death. 13 rows Property taxes in Colorado are among the lowest in the country with an average effective. The notices list the location classification the.

Colorado tax forms are sourced from the Colorado income tax forms page and are updated on a yearly basis. Colorado has a flat 455 percent state individual income tax rate. Senate Bill 238 sponsored by Democratic.

06 of home value. An effective tax rate is the amount you actually pay annually divided by the value of your property. What is the Property TaxRentHeat Credit rebate PTC Rebate.

Denver CO 80203 Phone. Jared Polis by unanimous vote on Friday a 700 million two-year proposed property tax cut for businesses and residences. Colorados high-stakes property tax battle ends dramatically as opposing sides agree to embrace 700M reduction.

Personal Property Notices of Valuation are mailed by June 15 of each year. Estate tax can be applied at both the federal and state level. Black Lives Matter co-founder Patrisse Cullors has admitted to throwing two parties at the organizations swanky 6 million Los Angeles mansion despite previously.

Senate Bill 22-238 would temporarily reduce residential and commercial property tax assessment rates providing 700 million in savings over two years for Colorado homeowners and businesses. Real Estate Tax Rate. NOTICE OF VALUATION.

The Division of Property Taxation coordinates and administers the implementation of property tax law throughout the state and operates under the leadership of the property tax administrator who is appointed by the State Board of Equalization state board. Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment. However estate income tax returns can be fairly complex even if there is very little income.

1 day agoColorado legislators sent to Gov. There are jurisdictions that collect local income taxes. The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000.

However not many states have an estate tax. Federal legislative changes reduced the state death. An estate is the collection of property you leave behind after death and estate taxes therefore are taxes that apply to that property.

In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Tax amount varies by county. A state inheritance tax was enacted in Colorado in 1927.

Colorado has a 455 percent corporate income tax rate. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. Real Property Notices of Valuation are mailed by May 1 of each year.

Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. Colorado has no estate tax for decedents whose date of death is on or after January 1 2005. While federal law still imposes estate taxes on certain estates only about two of every 1000 people who pass away or 02 percent have to pay any taxes at all.

When someone dies leaving behind property in the state of Colorado its possible for an estate tax to apply to it. May increase with cost of living adjustments. Colorado is ranked number thirty out of the fifty states in order of the average amount of.

The state of Colorado for example does not levy its own estate tax.

Colorado Property Tax Increases Could Be Capped By 2022 Ballot Measure Colorado Public Radio

Get Started On Homeownership First Time Home Buyers Va Mortgages Mortgage

How A 2010 Colorado Law Suddenly Stands To Change Internet Sales Tax Collection For Good Viral Marketing Marketing System Tax Lawyer

Property Taxes Understanding Your Colorado Tax Bill

Shopify Colorado Sales Tax Ecommerce Bookkeeping Services Business Structure

The 5 Best And 5 Worst Places To Run A Business Business Infographic Places In America Business Loans

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Best Colorado Springs Real Estate Colorado Springs Real Estate Colorado Colorado Springs

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Estate Tax Tax

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Colorado Property Tax Calculator Smartasset

Colorado Voters To Decide On Whether To Cut Income Taxes On The 2022 Ballot

Colorado S Low Property Taxes Colorado Fiscal Institute

How To Plan Around Estate Tax Uncertainties Charles Schwab In 2021 Estate Tax Capital Gains Tax Tax

Tax Rates Stranger Tallman Lautz Accounting Grand Junction Colorado

State By State Guide To Taxes On Retirees Tax Retirement Income Tax